Some Ideas on Property By Helander Llc You Need To Know

Some Ideas on Property By Helander Llc You Need To Know

Blog Article

Property By Helander Llc - Truths

Table of Contents9 Simple Techniques For Property By Helander LlcFacts About Property By Helander Llc RevealedFascination About Property By Helander LlcThe Best Guide To Property By Helander LlcThe Best Guide To Property By Helander LlcThe smart Trick of Property By Helander Llc That Nobody is Talking About

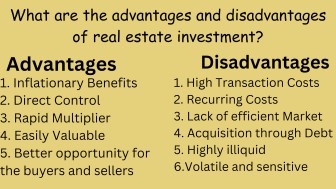

The benefits of investing in actual estate are numerous. Here's what you require to understand about real estate benefits and why actual estate is taken into consideration an excellent financial investment.The benefits of buying real estate include passive earnings, stable money circulation, tax advantages, diversification, and leverage. Property investment company (REITs) supply a way to spend in real estate without having to possess, run, or finance residential properties - (https://www.figma.com/design/UwIkjV8ROnHuf7LVUYd5Jq/Untitled?node-id=0-1&t=eOL6T3le1Ul6JHnU-1). Money circulation is the internet income from a property investment after mortgage settlements and overhead have been made.

In many situations, cash money flow only reinforces over time as you pay down your mortgageand accumulate your equity. Real estate capitalists can take benefit of various tax breaks and reductions that can conserve cash at tax obligation time. In general, you can deduct the affordable prices of owning, operating, and managing a residential property.

What Does Property By Helander Llc Do?

Genuine estate values have a tendency to boost over time, and with an excellent financial investment, you can transform an earnings when it's time to offer. As you pay down a residential property mortgage, you develop equityan property that's component of your web worth. And as you develop equity, you have the utilize to get more properties and boost cash flow and wide range even more.

Due to the fact that actual estate is a concrete property and one that can serve as collateral, funding is readily available. Real estate returns differ, depending on variables such as area, possession class, and administration.

How Property By Helander Llc can Save You Time, Stress, and Money.

This, consequently, equates right into greater capital values. Consequently, genuine estate has a tendency to keep the purchasing power of funding by passing a few of the inflationary stress on to lessees and by integrating several of the inflationary stress in the type of capital appreciation. Home mortgage borrowing discrimination is prohibited. If you believe you've been differentiated versus based on race, faith, sex, marital condition, use public help, national origin, special needs, or age, there are steps you can take.

Indirect real estate investing entails no straight possession of a residential or commercial property or properties. There are a number of methods that owning real estate can secure versus rising cost of living.

Residential or commercial properties funded with a fixed-rate lending will certainly see the loved one amount of the regular monthly home loan payments drop over time-- for instance $1,000 a month as a fixed settlement will certainly end up being less troublesome as rising cost of living wears down the purchasing power of that $1,000. (https://profiles.delphiforums.com/n/pfx/profile.aspx?webtag=dfpprofile000&userId=1891238286). Frequently, a key home is not taken into consideration to be a realty financial investment considering that it is used as one's home

The 9-Second Trick For Property By Helander Llc

Even with the help of a broker, it can take a few weeks of job just to discover the best counterparty. Still, realty is a distinct possession course that's easy to understand and can enhance the risk-and-return profile of a capitalist's profile. By itself, realty supplies capital, tax breaks, equity building, affordable risk-adjusted returns, and a bush versus inflation.

Investing in realty can be an unbelievably rewarding and lucrative undertaking, yet if you're like a great deal of brand-new capitalists, you may be asking yourself WHY you ought to be buying property and what benefits it brings over other investment possibilities. Along with all the incredible benefits that occur with purchasing property, there are some disadvantages you require to consider too.

Getting My Property By Helander Llc To Work

If you're looking for a way to get right into the property market without having to invest thousands of countless dollars, have a look at our homes. At BuyProperly, we utilize a fractional possession design that allows investors to begin with as little as $2500. One more major advantage of property investing is the ability to make a high return from purchasing, restoring, and reselling (a.k.a.

Get This Report about Property By Helander Llc

If you are billing $2,000 rental fee per month and you sustained $1,500 in tax-deductible costs per month, you will just be paying tax obligation on that $500 profit per month (Sandpoint Idaho real estate). That's a large distinction from paying taxes on $2,000 each month. The earnings that you make on your rental for the year is thought about rental income and will certainly be exhausted as necessary

Report this page